Euro Drops as Spain Economy Stalls, Irish Debt Concern Lingers

Euro Drops as Spain Economy Stalls, Irish Debt Concern Lingers

Nov. 11 (Bloomberg) -- The euro slid against the dollar and yen as France backed German calls to make investors share the costs of restructuring sovereign debt, Spain’s economy stalled and Ireland’s fiscal crisis drove down bank stocks.

The single currency declined versus 13 of its 15 most- traded peers, and approached the lowest in more than a month versus the greenback. The Dollar Index advanced for a fifth day, its longest run of gains since August, amid renewed concern that Europe’s so-called peripheral countries will struggle to cut budget deficits. The pound rose to a six-week high against the euro, boosted by speculation the Bank of England won’t extend its bond-purchase program.

“The focus is on the euro and what’s happening in the periphery,” said Daragh Maher, deputy head of global foreign- exchange strategy at Credit Agricole Corporate & Investment Bank in London. “We are at a critical point for the euro.”

The euro traded at $1.3709 at 6:51 a.m. in New York from $1.3783 yesterday, when it declined to $1.3671, its weakest since Oct. 5. Europe’s common currency slipped to 112.75 yen from 113.41 yesterday. The dollar was unchanged at 82.28 yen.

“All stakeholders must participate in the gains and losses of any particular situation” as a “point of principle,” French Finance Minister Christine Lagarde said during an interview with Bloomberg Television’s “On the Move” with Francine Lacqua.

Spain, Ireland

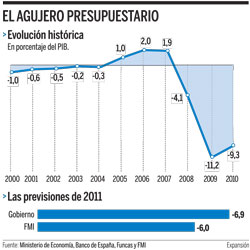

Spain’s third-quarter gross domestic product was unchanged from the previous three months after two quarters of growth, state statistics showed, as the nation implements the deepest austerity measures in three decades. The extra yield investors demand to hold 10-year Spanish bonds instead of German bunds climbed to 215 basis points today, the most since June.

Stoxx Europe 600 bank shares slid for a second day, paced by a 9.1 percent drop by Bank of Ireland, the nation’s largest lender. Irish debt spreads over German bunds surged to a record, a day after bond-clearing house LCH Clearnet Ltd. demanded clients place larger deposits when trading the nation’s debt.

European Union members are checking whether Ireland needs financial aid from a 750 billion-euro rescue fund, Handelsblatt said today, citing government officials it didn’t identify. Ireland hasn’t yet requested aid, the report said.

Europe’s common currency has lost 1.1 percent against nine developed-nation counterparts in the past week, Bloomberg Correlation-Weighted Currency Indexes show. The currency has dropped amid bets that the fiscal crisis in the region and potential bank losses will force the central bank to reverse plans to exit its stimulus measures.

Exit ‘in Tatters’

The “ECB exit strategy in tatters means strong euro story in tatters too,” Kit Juckes, London-based head of foreign- exchange research at Societe Generale AG, wrote in an e-mail today. “The ECB’s exit strategy drove euro rates and the currency. Even central banks don’t always get what they want for Christmas.”

IntercontinentalExchange Inc.’s Dollar Index, which tracks the currency against those of six major U.S. trading partners including the euro, rose 0.3 percent to 77.886. The dollar benefits from its status as a haven from financial turmoil.

The British pound gained 0.6 percent to 84.96 pence per euro, after trading at 84.88 pence, the strongest level since Sept. 28. It was 0.1 percent stronger at $1.6138.

The Bank of England, led by Governor Mervyn King, yesterday unveiled higher predictions for inflation next year and said prices are equally likely to exceed or undershoot the 2 percent target over two years. The bank also said it “stood ready to respond in either direction.”

Faster Gains

The dollar weakened earlier against most of its major counterparts after China’s yuan rose to the strongest level since 1993, fueling speculation the Asian nation is allowing faster gains as Group of 20 leaders meet in Seoul.

G-20 nations including China are trying to forge an agreement on currencies that goes beyond an accord reached by finance ministers and central bank governors last month, the group’s committee spokesman Kim Yoon Kyung said in Seoul today.

Finance ministers agreed in October to “move towards more market-determined exchange rate systems that reflect underlying economic fundamentals and refrain from the competitive devaluation of currencies.” G-20 leaders are gathering for a two-day summit starting today.

The U.S. currency slipped 0.2 percent to 6.6238 yuan.

--With assistance from Emma Ross-Thomas in Madrid, Ron Harui in Singapore and Monami Yui in Tokyo. Editors: Mark McCord, Peter Branton.

0 comentarios