UK going bankrupt?

There is talk in the UK among experts that the UK might just be facing the same sort of problems that are afflicting other European countries. There is a chance that the UK could become technically bankrupt.

In case you are too young to remember let me refresh you memory as to what happened the last time the UK was in a similar predicament.

Prior to the “Winter of Discontent” the Callaghan government had been forced (in 1976) to seek an International Monetary Fund loan. The root cause for this was a 12% fall in the value of the pound.

Oddly enough Labour was also in charge then. Now we have talking heads explaining that things are not as bad as they were in the 1970s. Sir Brian Pitman former head of Lloyds TSB which currently gone to the government for a bailout had this to say:while trying not to be alarming.

“We’ve been in a much worse position than we are today.

“People are getting unbelievably gloomy, but I have been around long enough to remember the 70s when we had to have the IMF [International Monetary Fund bail-out], we had a three-day working week, we had candles in rooms and we couldn’t get home by train.

“We are not going to have that.”

But things are not well. The government under Gordon Brown has decided to follow a Keynesian approach and borrow its way out of recession. The government plans to use public works to dig the UK economy out of its malaise. Alas, one side affect to this is UK debt spiraling out of control. This is a new record and one that worries many in the financial world.

If these facts don’t make you whine not much will. The best one can say is that its not as bad as the rest of Europe. Sure, the UK has not had to go to the IMF like the Hungary yet. That is hardly reassuring. The Telegraph’s Ambrose Prichard tries his best to explain the situation

It is because Gordon Brown exhausted the national credit limit to pay for his silly boom that today’s fiscal stimulus - just 1pc of GDP (China is doing 14pc) - is enough to rattle the bond markets. Our national debt will jump in what is more or less the bat of an eyelid from under 40pc of GDP to nearer 60pc - according to Fitch Ratings. It is enough to make you weep. But is this bankruptcy territory? Not yet. Britain will remain at the mid to lower end of the AAA club.

What bothers most is that Gordon Brown and his colleagues don’t seem to be at all perturbed about this huge increase in public debt. They harangue individuals for going into debt but the country is overdrawn on its accounts.

Others are not so sure the comparisons to the 1970s are that far off. They warn that the situation could get there very quickly.

What this means is that confidence in the long-term future of the British economy is roughly where it was during James Callaghan’s Winter of Discontent in 1978-79. Anyone who does lend, wants to be repaid quickly.

British politicians might not be worried that the current situation is similar to the 1970s, but those who invest seem to think they are already there. Philip Broughton returns to the bankruptcy meme and states the following.

“…Britain now finds itself with a falling currency and low investor confidence. Anyone looking for a reserve currency other than the dollar or yen gravitates to the euro over sterling. Britain has to go the Argentina route and start offering higher interest rates to potential lenders simply to pay its interest bills.”

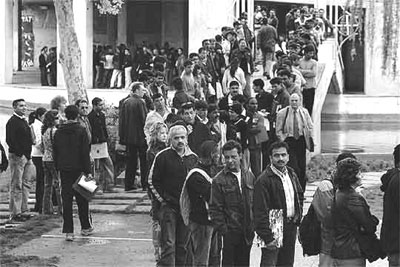

And similar to 1970, the trade unions are itching to pressure the Labour government for wage increases above the rate of inflation. As I have written before unions are threatening to strike. While there is no sign of anything on the scale of the “Winter of Discontent,” there are rumblings of active discontent on the back benches.

A character on the popular sit-com “Dad’s Army” was famous for rushing around flapping about while yelling “Don’t Panic.” What we are seeing from the UK is similar behavior.

The trouble is, of course, that no one is believing a word of it. The gloom and doom that pervades the City of London and Westminster has reached the high street in the UK. Are they listening to anyone or merely reaching to their battered 70s political playbook?

What will it take to re-establish investor confidence in the UK?

0 comentarios